Alumni

Jonathan Zhou

Bio

Jonathan Zhou is a rising junior at Horace Greeley High School from the hamlet of Chappaqua, in Westchester County, NY. Possessing an interest in the sciences as well in history and philosophy from a young age, he is now well versed in machine learning, artificial intelligence, and other computer technologies. He currently examines various problems in bioinformatics for Science Research and is now also a published author. Apart from his interests in academia, he also enjoys playing piano and is an executive of his school's table tennis club. He is fluent in Mandarin Chinese and studies Latin in school.

Project: Examining Stock Pricing "Anomalies"

Goal

Stock markets are volatile environments in which there is wild fluctuation. This project explores the notion of "anomaly" within the market. Stock returns for the Dow Jones Industrial Average and its components are aggregated as a function of time. This signal is transformed into an anomaly curve by utilizing previous time points to examine the probability that a current time point arose from the distribution of prior time points (estimated by kernel density estimate). The stability and fidelity of this method of anomaly detection was assessed via comparisons to baselines. Statistical analysis and visualization were performed to assess the relation of volatility and return on anomaly as well as inter-anomaly correlation. The notion of systemic anomaly is also explored.

Summary of Results

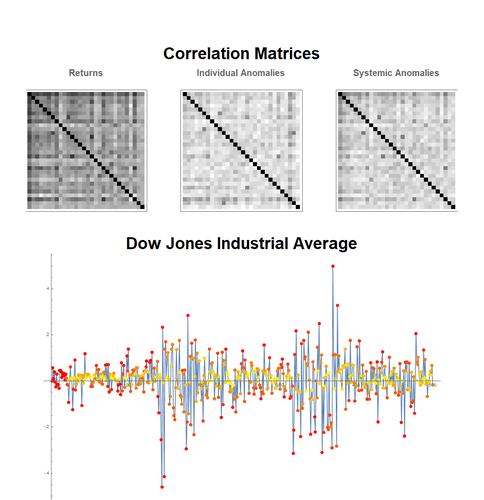

In summary, a collection of anomaly time series was generated for the Dow Jones and its components via the use of KDE and RarerProbability. Bugs in the Wolfram implementation of both routines were addressed. Because of these issues, the stability of the KDE anomaly detection routine was examined. Following this, the anomaly time series signal was visualized in a variety of manners. It was determined that anomaly is not simply the product of volatility, as there is no correlation between the two. It was found that there is a notion of systemic anomaly in the market: when more than 2/3 of the stocks are anomalous (P(anomaly)>=0.5), the Dow Jones is down, while when there are less than 1/3, the Dow Jones is up, even though, individually, the anomaly score for all stocks is relatively uniform. Systemic anomaly is hinted at when examining average anomaly across time. Returns are relatively correlated with each other, while the individual anomalies are all rather independent. However, on the systemic anomalies, the Dow Jones anomalies appear to be highly correlated with the anomalies of each of the individual components, indicating a systemic but non-pairwise risk.

Future Work

In the future, I aim to refine the stock pricing anomaly conversion model and perform further analysis with the anomaly signal. Problems with the non-deterministic nature of the routine must be addressed and more methods of anomaly detection should be explored. The fidelity of these methods should be examined with rigor. Further work on examining the notion of systemic anomaly should be performed to yield more insight into the nature of market anomaly. Other data sources may be incorporated (e.g. macroeconomic factors, recent events) to facilitate this task. More stocks may be examined beyond the Dow Jones. The anomaly signal itself may also be examined in further detail to took for patterns such as those of seasonality.