Alumni

Bio

Cheng Shi is a student at Indiana University Bloomington. He is pursuing his bachelor of science degree in applied mathematics, and his bachelor of arts degree in Italian. Cheng is a member of the Hutton Honors College at Indiana University, which recognizes exceptional academic achievements of students in their undergraduate studies.

Cheng considers himself an applied mathematician with a concentration in statistics and data science. He believes that he is able to apply his strong mathematical and data analysis skills to many different fields. He worked in the James T. Townsend Mathematical Psychology Lab from June 2015 to February 2016. His work focused on utilizing multidimensional scaling to discover general descriptions of the perceptual space of human subjects. He modified perceptual spatial models, including decision-bound, systems factorial technology and select influence with knowledge of stochastic probability theory. Moreover, he also derived SIC functions for both parametric and nonparametric distributions for various architectures and stopping rules with constant capacity of cognitive process. Besides cognitive science, Cheng also has impressive experience in actuarial science. In 2016, he attended the Society of Actuaries (SOA) Student Challenge and was a semifinalist.

Cheng’s current interests are data science and machine learning. He looks forward to participating in the Wolfram Summer School, meeting with different successful scholars in different fields and applying Wolfram technology to his field of interest.

Project: Using Wikipedia Edits History to Predict the Future Stock Price Change

Behavioral economics already proved that emotions affect individual decision making. This project will test whether the measurement of the mood of Wikipedia’s edits history correlates to the change of stock prices. The project can be divided into four parts: sentiment analysis of Wikipedia’s edits history, generating the financial data from NYSE, visualizing the correlation between sentiment analysis and stock price and predicting the future stock price by providing a sentiment analysis value. Ten sample companies will be analyzed in this project. These ten sample companies are from the top ten controversial companies listed on the 2015 CRN report. These sample companies are: British Petroleum, Oracle Corporation, VMware, Hewlett-Packard, HSBC, Sony, JetBlue, General Motors, Microsoft and Target. The time span of Wikipedia’s edits history and financial data is from January 1, 2014, to July 1, 2016.

The sentiment analysis has three levels: positive, negative and neutral. Each level will be assigned a numerical value: 1 for positive, -1 for negative and 0 for neutral. Hence the analysis will be focusing on the correlation between average sentiment value of Wikipedia’s edits history and the stock price of given companies.

If a strong correlation exists between the measurement of the mood of Wikipedia’s edits history and the change of the stock price, then companies should be able to predict the future stock price change and benefit from it.

Man GroupBrevan Howard

Och-Ziff Capital Management

BlackRock

Winton Capital Management

Highbridge Capital Management

Cerberus Capital Management

Angelo, Gordon & Co.

AQR Capital

Farallon Capital

Goldman Sachs

Elliott Management Corporation

JPMorgan Chase

Deutsche Bank

HSBC

Barclays

Merrill Lynch

Morgan Stanley

Berkshire Hathaway

Citadel LLC

Harris Associates

First Eagle Investment Management

Pine River Capital Management

Renaissance Technologies

Kohlberg Kravis Roberts

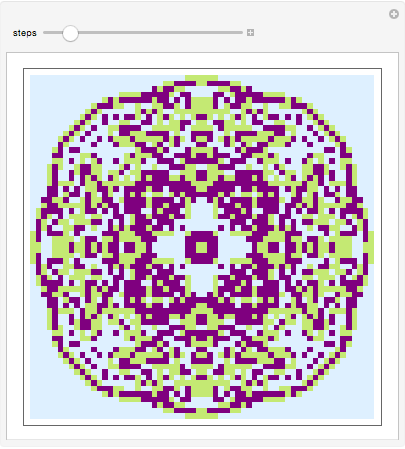

Favorite 3-Color 2D Totalistic Cellular Automaton

Rule 867848573